VAT criticisms?

VAT criticisms?

- This topic has 94 replies, 38 voices, and was last updated 16 December 2016 at 10:49 by

Circlip.

- Please log in to reply to this topic. Registering is free and easy using the links on the menu at the top of this page.

Latest Replies

Viewing 25 topics - 1 through 25 (of 25 total)

-

- Topic

- Voices

- Last Post

Viewing 25 topics - 1 through 25 (of 25 total)

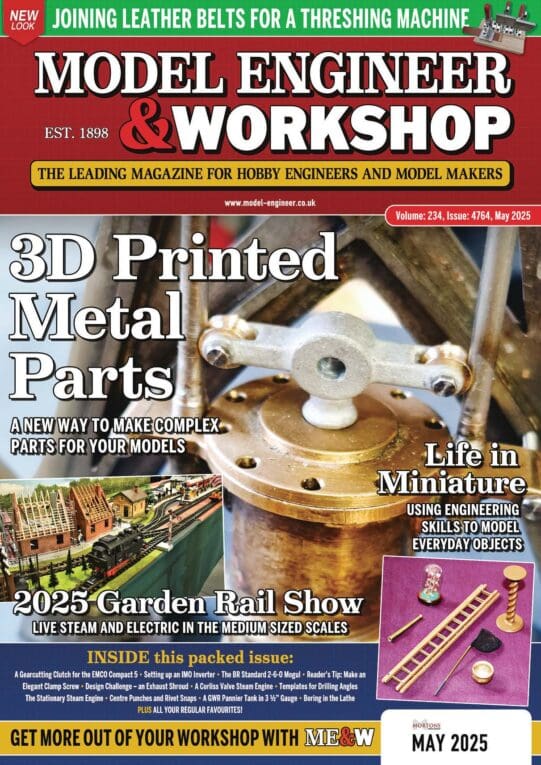

Latest Issue

Newsletter Sign-up

Latest Replies

- Scam email

- S&B Sabel lathe quick change tool post

- What size gear cutter for gear

- bolts harness and head shearing?

- Stuart Twin Victoria (Princess Royal) Mill Engine

- Mystery Object found in FE College

- Myford Super-7 chuck – unacceptable run-out??

- FreeCAD v1.0 tutorials

- Comm Ads

- Countersinking carbon fibre sheet with my Sieg CNC Mill