Outdoor Workshop Insurance – Advice Welcome

Outdoor Workshop Insurance – Advice Welcome

- This topic has 17 replies, 13 voices, and was last updated 25 May 2015 at 20:32 by

Owain Samuel.

Viewing 18 posts - 1 through 18 (of 18 total)

Viewing 18 posts - 1 through 18 (of 18 total)

- Please log in to reply to this topic. Registering is free and easy using the links on the menu at the top of this page.

Latest Replies

Viewing 25 topics - 1 through 25 (of 25 total)

-

- Topic

- Voices

- Last Post

Viewing 25 topics - 1 through 25 (of 25 total)

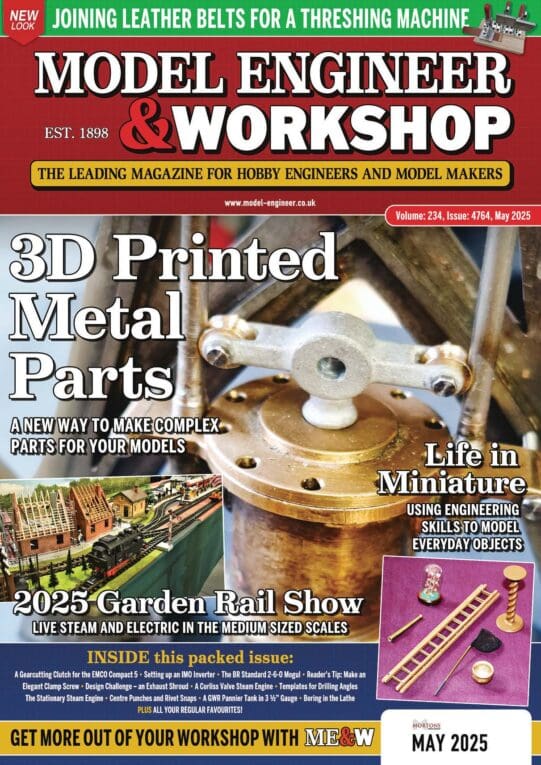

Latest Issue

Newsletter Sign-up

Latest Replies

- How To Make A Pressure Gauge Syphon?

- Building Bernard Tekippe’s Precision Regulator

- Broken casting – Best repair?

- Motor bearings and more

- Tensile Strength Machineability

- 3D printer choices

- What Did You Do Today 2025

- Power hacksaw – powerful banging when running

- 1920s Cradle Mic Antique Brass Sleeve

- Low Current Power Bank

I had the bright idea of adding it to the house insurance. This idea came to a dramatic halt when I got the reply "what's a lathe?" when opening negotiations. Images of the total farce that might come if I ever had to claim flooded into my brain. This idea was shut down quickly.

I had the bright idea of adding it to the house insurance. This idea came to a dramatic halt when I got the reply "what's a lathe?" when opening negotiations. Images of the total farce that might come if I ever had to claim flooded into my brain. This idea was shut down quickly.