National Trust and Gift Aid

National Trust and Gift Aid

- This topic has 21 replies, 15 voices, and was last updated 18 February 2019 at 10:41 by

Vic.

Vic.

Viewing 22 posts - 1 through 22 (of 22 total)

Viewing 22 posts - 1 through 22 (of 22 total)

- Please log in to reply to this topic. Registering is free and easy using the links on the menu at the top of this page.

Latest Replies

Viewing 25 topics - 1 through 25 (of 25 total)

-

- Topic

- Voices

- Last Post

Viewing 25 topics - 1 through 25 (of 25 total)

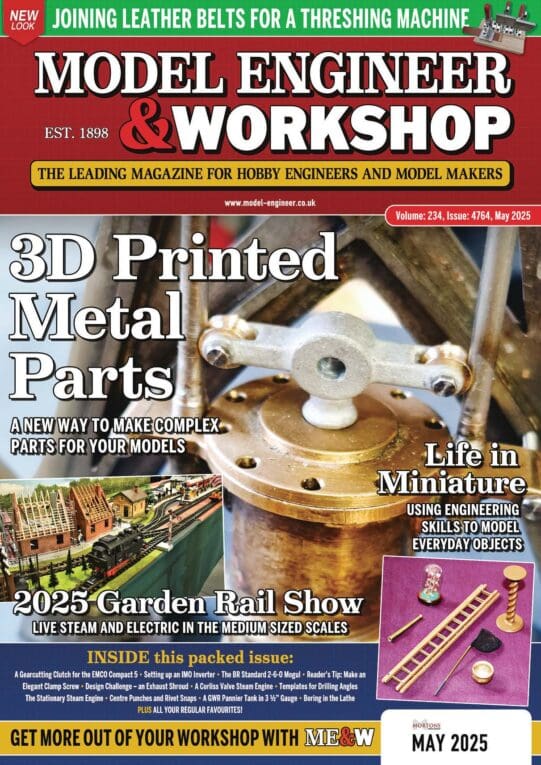

Latest Issue

Newsletter Sign-up

Latest Replies

- Stuart Twin Victoria (Princess Royal) Mill Engine

- Building Bernard Tekippe’s Precision Regulator

- Bending EN24t

- mt4.5

- Small horizontal mill – capabilities?

- Anyone know about wells and Victorian plumbing?

- French Curves

- Some help with a Cowells speed controller needed.

- Change Wheels

- Amazing Fellow and his musical machines..