Insurance companies

Insurance companies

- This topic has 17 replies, 13 voices, and was last updated 12 October 2016 at 21:38 by

Halton Tank.

Halton Tank.

Viewing 18 posts - 1 through 18 (of 18 total)

Viewing 18 posts - 1 through 18 (of 18 total)

- Please log in to reply to this topic. Registering is free and easy using the links on the menu at the top of this page.

Latest Replies

Viewing 25 topics - 1 through 25 (of 25 total)

-

- Topic

- Voices

- Last Post

Viewing 25 topics - 1 through 25 (of 25 total)

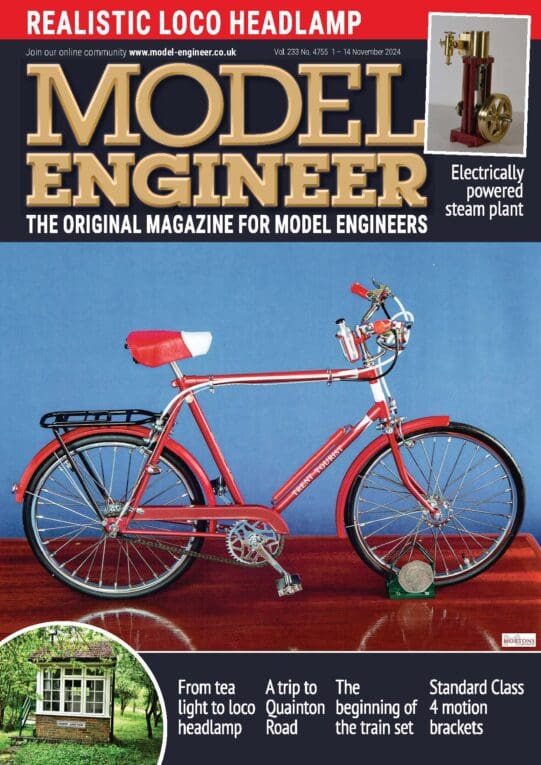

Latest Issues

Newsletter Sign-up

Latest Replies

- ELS for BOXFORD AUD

- Strange drilling situation

- What is (Traditional) Model Engineering?

- Rite of Passage build – Elmers Standby

- Thread pitch of screws used on Stihl equipment

- BLACKMAIL

- Co-ordinate positioning for circle of holes (not all equally spaced)

- Chester Super Lux advice

- Jaguar [oh dear]

- 775 Motor based Dynamo ?